-

play_arrow

play_arrow

The CRUSADE Radio Network CRUSADE Radio Network

-

play_arrow

play_arrow

The Church Doctrine Episode 2 - O Brother, Wherefore Art Thou? The Church Doctrine Episode 2

-

play_arrow

play_arrow

Audio Post Format TheKingDude

Mandeville, LA – Exclusive Transcript – There is no money, ladies and gentlemen. This greatest house of cards in the history of house of cards that has been erected by all these financial geniuses is doomed to collapse. It’s going to happen. This is inevitable. I don’t believe that this is me just postulating about this and running my mouth. I believe that certain economic principles that you can’t change the laws of physics and you can’t change certain economic principles. If you continue to run debt up and spend resources that you do not yet have, at some point in time, you will have to repay for the resources already squandered, and they’re going to have a negative impact on the present. We are nearly or are at that moment.

Begin Mike Church Show Transcript

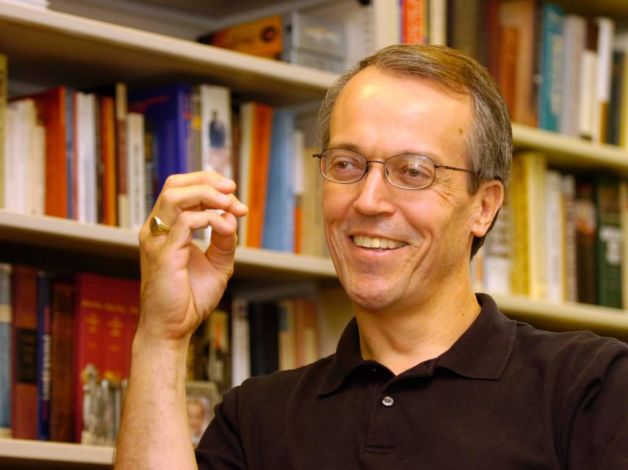

Mike: I asked Anthony Sanders, Professor Sanders, our good friend, I asked him for a comment on whether or not this piece that I sent to you earlier today was just a bunch of paranoid bluster or did it have some voracity to it. The piece is posted at ZeroHedge.com. The title: “The End Game: 2012 and 2013 Will Usher in the End” – The Scariest Presentation Ever?

[reading]

If Raoul Pal was some doomsday spouting windbag, writing in all caps, arbitrarily pasting together disparate charts to create 200 page slideshows, it would be easy to ignore him. He isn’t. The founder of Global Macro Investor “previously co-managed the GLG Global Macro Fund in London for GLG Partners, one of the largest hedge fund groups in the world. Raoul came to GLG from Goldman Sachs where he co-managed the hedge fund sales business in Equities and Equity Derivatives in Europe… Raoul Pal retired from managing client money in 2004 at the age of 36 and now lives on the Valencian coast of Spain, from where he writes.” It is his writing we are concerned about, and specifically his latest presentation, which is, for lack of a better word, the most disturbing and scary forecast of the future of the world we have ever seen….and we see a lot of those.

[end reading]

Mike: Then he goes into this problem that we are seeing the tip of the iceberg disintegrating in the European markets, which is having an adverse effect on the stock run, I’m talking about the New York Stock Exchange run, at a mere, what, four or five weeks ago. Shepard Smith over at FOX News at Studio B was doing back handspring vaults across the set, having clown actors on and celebrating the end of the recession, happy days were here again. Look at that market go. Then what happened? Well, Europe happened. The startling thing to me, and the only reason I bring it up, because you have been sending me bits and pieces of what’s going on in Spain and the debt problem that they have, which is going to explode any day. I know, it’s been supposed to go off for a year. It’s going to go off. It will happen. Spain is but a backwater compared to the entire European Union.

[reading]

The problem is not government debt per se. The real problem is that the $70 trillion in G10 debt is the collateral for $700 trillion in derivatives. [Mike: Can you imagine $700 trillion? If you can’t imagine a trillion, how can you imagine 700 of them?] Yes, that equates to 1200 percent of Global GDP and it rests on very, very weak foundations. From an EU crisis, we only have to join one dot for a UK crisis of equal magnitude. And then Japan and China are next. Do you think the US is going to survive this?

[end reading]

Mike: No. The recipient of most of our exports, our number one exporting partner is Europe. They, the Europeans, receive most of I believe 20 percent, of our exports. Mort Zuckerman was on with Neil Cavuto yesterday. We are waiting with baited breath the May jobs report this morning, right? We’re going to find out just as we go off the air what the UE number is, or what the Bureau of Lying Labor Statistics claims it is. It’s supposed to hold at 8.1 percent. That’s what all our brilliant economists that are leading us all, shepherding us all through these difficult economic times tell us. Mort Zuckerman ain’t buying any of it. He’s publisher of Newsweek magazine. He is an entrepreneur from the word start. He was on with Neil Cavuto yesterday. This is part of what Zuckerman told Cavuto.

[start audio clip]

Neil Cavuto: You’re a pretty savvy businessman. Isn’t the argument with Greece and all let’s quit giving good money after bad? We keep revisiting this.

Mort Zuckerman: Right.

Cavuto: So it would be like you investing at eleven and adding money to it. Would you do it?

Zuckerman: The real question is will it cost you more to solve the problems that a Greek default would bring about?

[end audio clip]

Mike: Will it cost more to solve the problem? They’re going to get a bailout, aren’t they? Where are they going to get the bailout from? These guys over here are going to print the money. Okay, where are they going to get it from? Well, they’re going to get the money back they borrowed from the Italians. Where are the Italians going to get it from? They’re going to get the money back that they loaned to the Irish. Where are the Irish going to get it from? They’re going to get the money back that they loaned to the Icelanders. Where are the Icelanders going to get the money from? They don’t have any money.

There is no money, ladies and gentlemen. This greatest house of cards in the history of house of cards that has been erected by all these financial geniuses is doomed to collapse. It’s going to happen. This is inevitable. I don’t believe that this is me just postulating about this and running my mouth. I believe that certain economic principles that you can’t change the laws of physics and you can’t change certain economic principles. If you continue to run debt up and spend resources that you do not yet have, at some point in time, you will have to repay for the resources already squandered, and they’re going to have a negative impact on the present. We are nearly or are at that moment. The DOW was down what, six percent in May? I believe the number is six percent. What has been the cause of that? They say it’s the European market. Is it really? It’s not getting any better here either. One more cut from Zuckerman:

[start audio clip]

Zuckerman: We have never been into anything like this.

Cavuto: What about our own recovery here? Growing doubts about it that we’re going back into something bad?

Zuckerman: For sure.

Cavuto: What do you say?

Zuckerman: Number one, you see all the statistics now coming out, which are most worse than most people expected, although I have to say, as you know, I’ve been bearish about the way the economy is going now for several years, and I’m still bearish about it.

Cavuto: I think you said last time we’ve been papering over our problems.

Zuckerman: Yes. What has happened now is that the employment numbers are much worse than they look because of how they are measured. The Bureau of Labor Statistics last month, when we said we created 115,000 jobs, that was nonsense. Why? Because there’s something called the birth/death series. It refers to startup companies and companies that shut down. The net numbers that came out of that were 206,000 jobs, which is just a complete historical shall we say guesstimate. If they had gone just to the numbers of last year, we would have created less than 100,000 jobs. That is not enough. Even the job numbers now that are coming out, because we need 150,000 jobs —

Cavuto: So it’s bad. Bottom line is bad.

Zuckerman: The employment is bad. The housing numbers are bad. Consumer confidence is bad. Consumer sales are bad. When I say bad, they are not as bad as they are in Europe, but they are very weak. This is something that feeds on itself. We have to understand, the context is the most stimulative fiscal and monetary policy in our history. The economy should be growing at anywhere from six to eight percent based on previous, and it’s not even growing at two percent. Something is fundamentally wrong. We don’t know exactly what it is.

[end audio clip]

Mike: Oh, yeah, we do. We know exactly what it is. We are living beyond our means. We are regulated out the wazoo. You can’t swing a dead cat without hitting a government bureaucrat. We know exactly what it is. We’re plowing trillions of dollars, significant portions of our productivity into unproductive means: government. It doesn’t produce anything; it consumes it.

End Mike Church Show Transcript

Written by: ClintStroman

anthony sanders cavuto debt europe market raoul pal shep smith zuckerman

Similar posts

Featured post

Latest posts

Current show

Upcoming shows

Mike Church West Coast Replay

Same Awesome Show For West Coast Morning Drive

9:00 am - 12:00 pm

Mike Church Stolen Election Chronicles

The Year That Was Anno Domini MMXXI

12:00 pm - 3:00 pm

Mike Church Show Afternoon Replay

If You Missed The Live! Morning Drive Version

5:00 pm - 8:00 pmMike Church Show Weekend Best Of

12:00 am - 11:59 pm

Condimentum Elit

11:40 pm - 11:55 pm

Chart

HERE IT GOES YOUR COPYRIGHT TEXT. CAN ALSO CONTAIN LINKS LIKE THIS

Post comments (0)